Then I'll talk about some of the other items I've been asking staff to provide for more than 6 months.

1. Is using the TIF dollars to help build these houses making it so that the residents of Carriage Trails pay less toward city services, like police and fire, than those in other parts of the city? (the answer is generally no, on average the Carriage Trails residents pay slightly more in combined property and income taxes than the average resident).

2. Does the city come ahead financially when providing the supplements?

Where do TIF dollars come from?

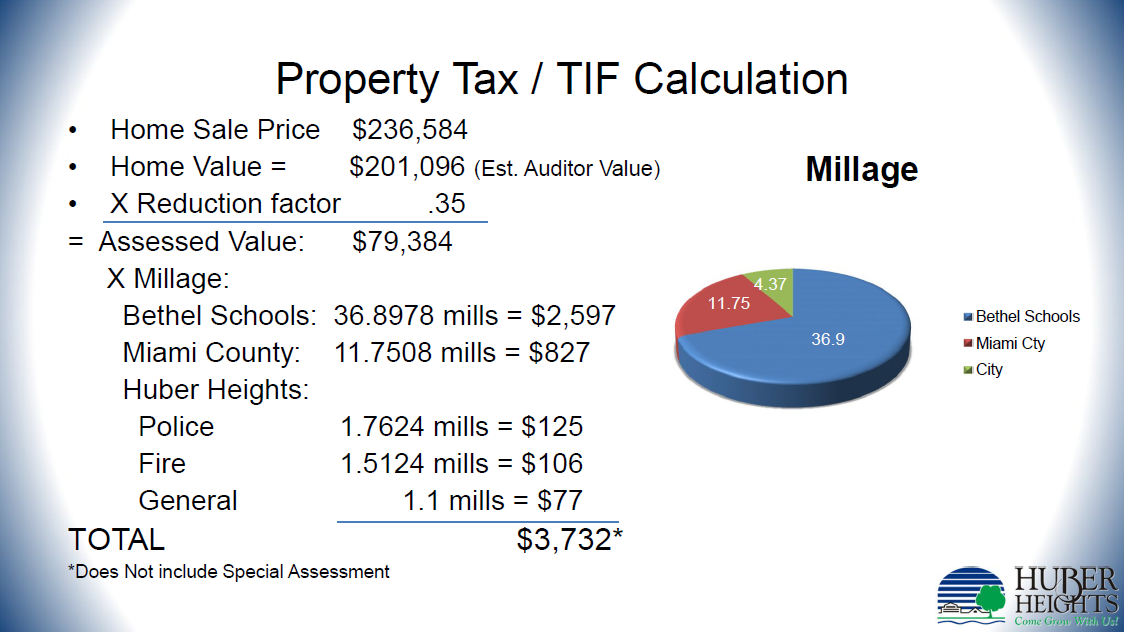

I'll explain this using the first page in the presentation given by the Assistant City Manager (see the entire presentation). I'm going to use the first page but I'm going to use it in three different ways.

First this is how it is presented in the presentation:

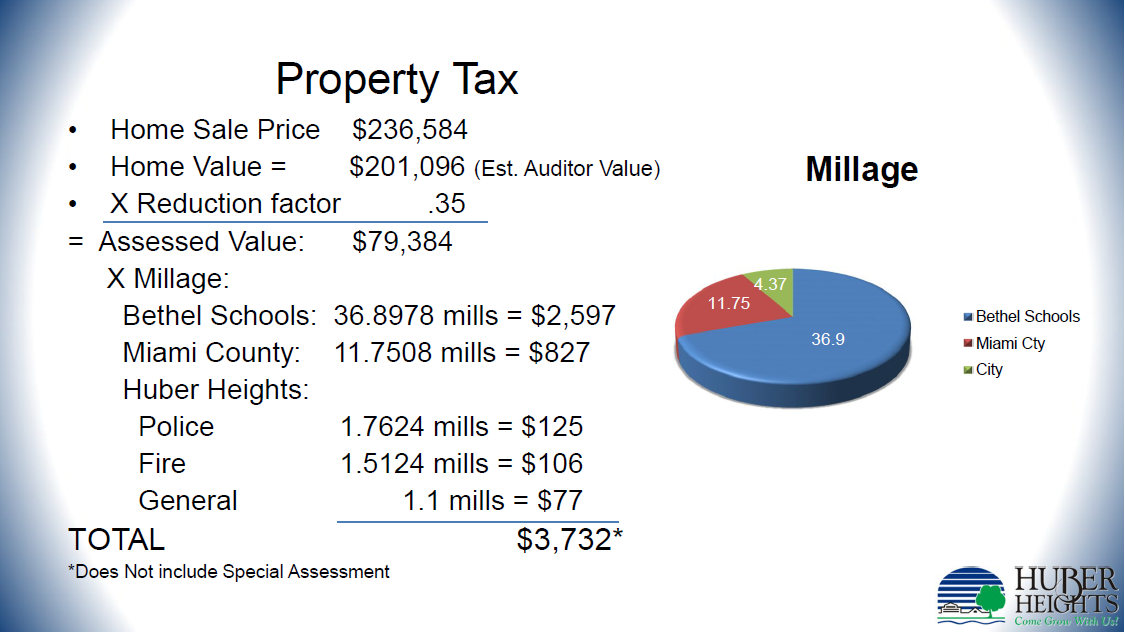

This is the same slide but I cut the words that "TIF Calculation". Now what the slide tells you is how much property tax is paid on a typical Carriage Trails house and that those property taxes go to three places; the Bethel Schools, Miami County and Huber Heights.

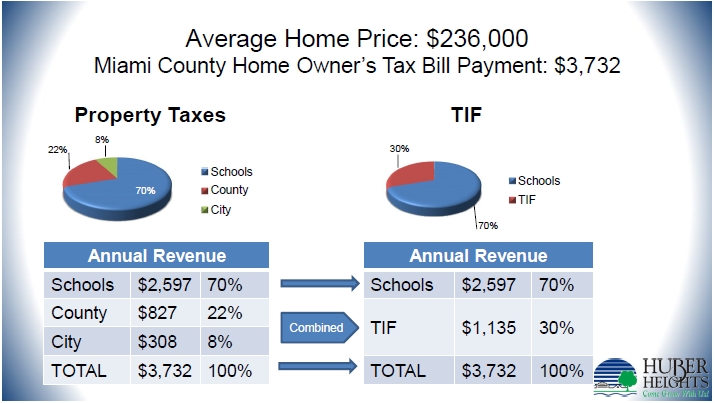

In the Carriage Trails TIF the same amount of money is collected from the home owner as they would pay in property taxes. However, that money is no longer considered property tax. It is considered payment in lieu of taxes aka TIF payments. In this TIF the Bethel Schools get to keep 100% of the money they would normally get to keep and the City gets to keep all the rest.

This is where TIF money comes from.

-------------------------------------------------------------------------------------------------------------

So it may seem obvious that this is a good deal for the city because the city gets to spend $827 of the County's money and $308 of city money ($1,135 total) on infrastructure and it only cost us $308 of police and fire money. However, when I first wrote articles on this months and months ago I calculated early supplements of about $22,000 a lot and recent supplements of $15,000. If each home were to pay $1,135 per year for 20 years into the TIF pot and the city was paying interest on the $15,000 loan for 20 years then back of the envelop calculations tell me the amount in principle and interest is about the same as the amount collected as TIF. If this is the case then almost all the infrastructure that the city was buying was going into that lot. So it appears the only direct money the City was getting out of all this "extra" TIF collection was the income tax paid by the families that bought the houses.

I asked the question, "is the income tax paid by these families on average high enough to make up for the fact that all the property tax they pay goes toward building the lot for their homes?" Last night the assistant City Manager told us that the average income tax revenue from all the residents of the city combined is about $1,147 per home and the average property tax to the city is $146 per home for a total of about $1293 per home. While the average income tax paid per home in Carriage Trails is $1,575. Therefore, even with no property tax going to the City on average each home in Carriage Trails contributes more toward city services than the average home in the city. Obviously there are individuals and even developments that probably contribute more. For instance, the portion of my property tax that goes to the city is about average at $152 but my income tax is more than 2 times the average. However, if I had the same job but it was in the City of Dayton on not at WPAFB I would still make the same amount of money but I would pay $0 dollars in income tax to Huber Heights. That's how averages work.

---------------------------------------------------------------------------------------------------

Looking at the rest of the presentation and you may get the impression that the City will be hand over fist in money by building these houses. I believe that the city will benefit but I have many issues with taking these numbers at face value as the complete picture. As an example if you look at the rest of the agenda for this same Council Work Session you will find Traffic Signal State Route 202 arriage Trails Boulavard - Award Contract The $130,000 needed to put in this light is a direct result of building houses in Carriage Trails, yet we as residents see no attempt to capture these costs as an offset to all the positive numbers we see in documents like the presentation. I as Mayor am frustrated that we still create documents like the presentation that are better classified as sales documents than they are useful documents that help us make informed decisions. Note: I helped construct the numbers found in the presentation so don't get the wrong impression and think those are not important. It's the fact that we don't go to the water department or streets department and ask about potential costs for pump stations or water towers that should also be factored in that I think should also be addressed. etc

----------------------------------------------------------------------------------------------

One other item came up last night concerning the City's obligations under the contract. Remember this is a work session. Obviously it would be nice if everyone in there came with all knowledge about every item, but if that were the case, why would we need a work session? The item about the contract seemed to be a counter to what we decided was accurate when we reviewed the contract months ago. So we are reading it again to see if we missed something then.

Caveat: Again we hear numbers such as average income tax per home of $707 but I don't have that in writing. When I am successful we will see all this information presented smartly on the official city website and we won't have to rely on my unofficial mayor's blog.

____________________

I re-listen to the oral presentation of the Power Point given on March 8, 2016, at 2 hours and 31 minutes it was stated that the average Carriage Trails home pays income tax on $70,000 while on average the City collects $51,000 per house. This calculates to $1,575 and $1,147 for a difference of $418 in income tax differences. I corrected the paragraph above to show these updated numbers. In the original paragraph below I used $707 and $500 in income tax with a difference of $207.

Here is the original paragraph which I correct for the data given in the oral report.

___________ Obsolete -- Uncorrected original paragraph from above _____________________

Edited

Edited

Comments

There have been no comments yet