|

An Ordinance Authorizing The Repeal Of Ordinance No. 2012-O-1977 Approving The First Supplement And The Execution Of A Sixth Amendment To Amended And Restated Development Agreement With DEC Land Co. I LLC, And Declaring An Emergency. |

|||||

| Purpose and Background | |||||

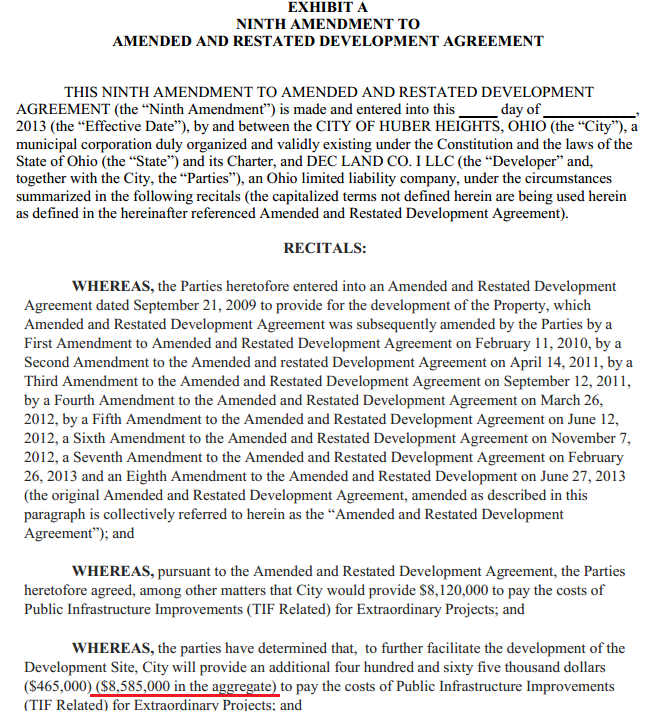

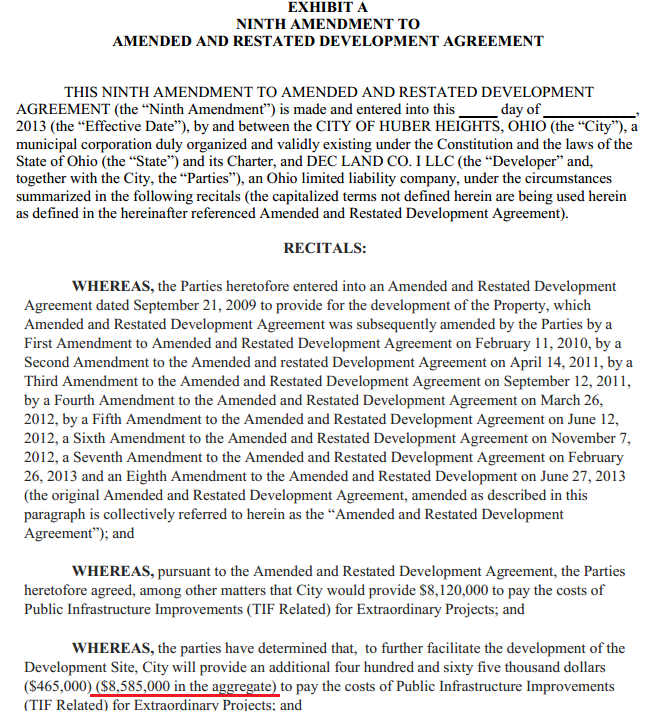

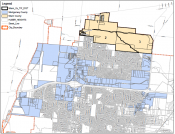

| This ordinance repeals Ordinance No. 2012-O-1977 which allowed the City to purchase 60 acres of land within the Carriage Trails subdivision for $1.8 million and allowed DEC the option to repurchase the land at a later date if they so desired. This ordinance repeals that ordinance and continues to allow the City to advance TIF revenue to the project in the amount of $1.8 million in additional funds. The City will use these funds to reimburse the developer for the cost of public infrastructure within the property. The developer will agree to produce 126 new lots by this time next year. The developer will also agree to donate 60 acres of land to the City free of all encumbrances and the City will offer an option to the developer to repurchase the land should they see fit within two years at a cost of $30,000 per acre. |

In essence the repealed portion and the implemented portion were the same arrangement except if the original law had remained the $1.8 million dollar payment would have had to go to either a TIF fund or to pay off the TIF debt.

Original Article -----

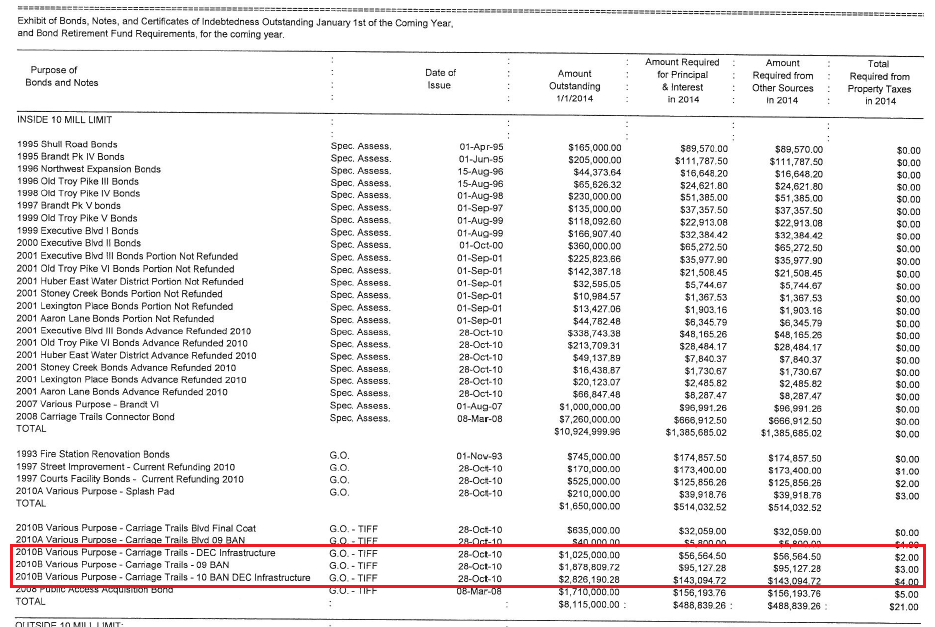

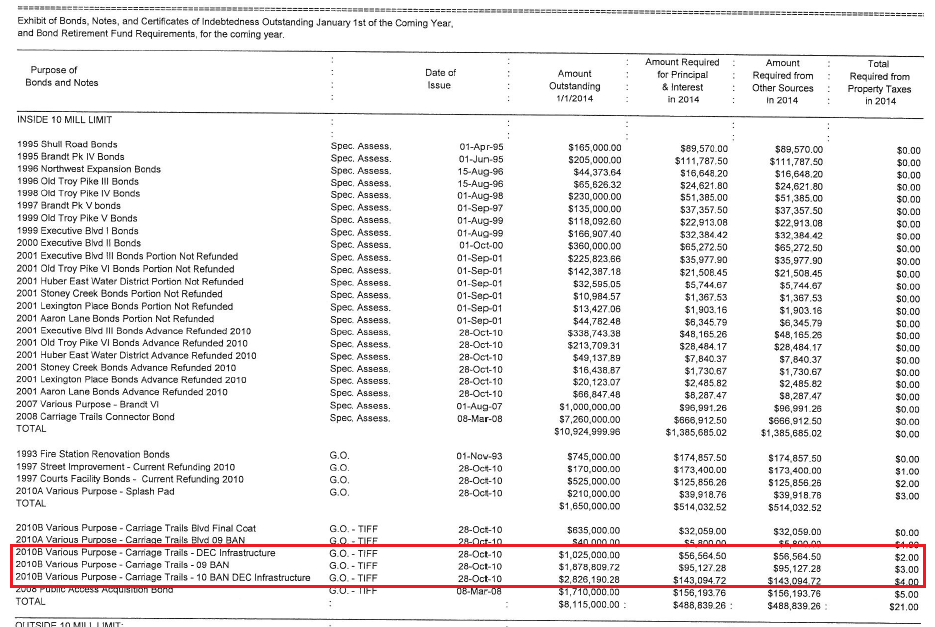

Huber Heights city council has been borrowing money to help develop Carriage Trails ( $8,585,000 total with $3.7 million this year) in accordance with the Restated Development Agreement with DEC.

Watch as the city turns tax payments into dividends If you can't tell there is a video above this message -- hit refresh or F5 |

|

| The Restated Agreement has been in place since 2009 and according to the ninth amendment the city has borrowed a total of $8,585,000 as part of this agreement. | |

| The agreement is constructed so that DEC makes payments consistent with an amount that would allow the city to pay off the loans. Even though DEC has made payments, since last October council needed to pass the 6th, 7th, 8th and 9th amendments committing the city to borrow $1,800,000, $700,000, $720,000 and $465,000 in order for the project to continue. On Sept 23, 2013 DEC presented council a check for $1,800,000. During the presentation the Mayor and the DEC representative called the payment a dividend. According to the agreement it is a TIF payment (this is just another way of saying modified property tax). I almost called it a loan payment in the title because it is meant to pay off the loans the city took in order to help the development. I didn't call it a loan payment though because I couldn't figure out from the budget documents or council agenda's if the city is planning on using much of this check in order to pay back these loans. |

|

Huber Heights city council has been borrowing money to help develop Carriage Trails in accordance with the Restated Development Agreement with DEC.

The Restated Agreement has been in place since 2009 and according to the ninth amendment the city has borrowed a total of $8,585,000 as part of this agreement.

The agreement is constructed so that DEC makes payments consistent with an amount that would allow the city to pay off the loans.

Even though DEC has made payments, since last October council needed to pass the 6th, 7th, 8th and 9th amendments committing the city to borrow $1,800,000, $700,000, $720,000 and $465,000 in order for the project to continue.

On Sept 23, 2013 DEC presented council a check for $1,800,000. During the presentation the Mayor and the DEC representative called the payment a dividend. According to the agreement it is a TIF payment (this is just another way of saying modified property tax).

I almost called it a loan payment in the title because it is meant to pay of the loans the city took in order to help the development. I didn't call it a loan payment though because I couldn't figure out from the budget documents or council agenda's if the city is planning on using much of this check in order to pay back these loans.

Edited

Edited