When a TIF is created it baselines the current value of a property and locks in the amount going toward property taxes. When development occurs this changes the valuation of the property and the property owner gets an increased "tax" bill. However, instead of the increase in "taxes" going to those that get the normal levies, it gets distributed differently based on how the TIF was created.

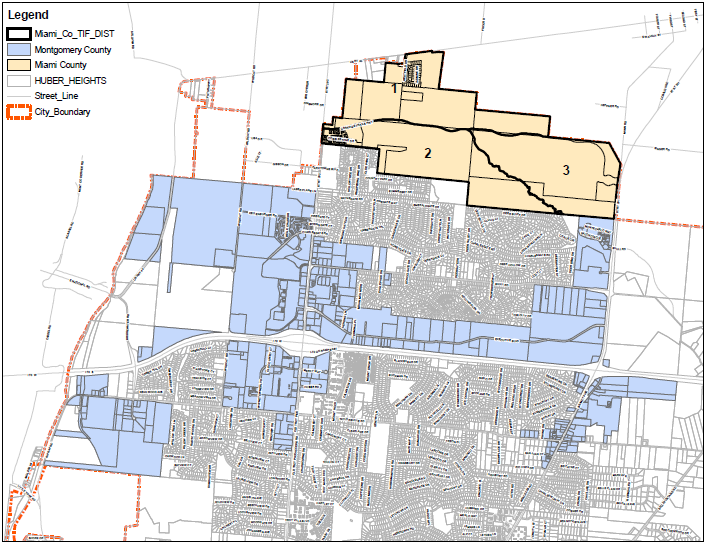

Sometimes it gets distributed in a way so that the schools end up with the same amount of money as they would if the TIF had not been created. The Miami County TIFs shown in tan are an example of this kind of TIF.

Sometimes they get distributed so the City ends up with some of the money that would normally go to the schools. The Montgomery County TIF shown in blue is an example where 75% of the TIF money goes to the City and 25% of the TIF money goes to the schools. Since normally about 65% of property tax goes to the schools, 6 % goes to the city and the rest goes to county/library etc you see the city is getting a decent amount of school money from the Montgomery County TIF shown in the picture.

In this case though, these both were acceptable usage of the TIF (especially when created) because these TIFs were using the TIF payments for infrastructure improvements that hastened development of the properties.

Later the city started to implement a plan to TIF every property that was planned for development even if they did not need infrastructure improvements, essentially siphoning off a lot of school money with no benefit to the schools.

I am trying to get people up to speed so they are knowledgeable enough to welcome responsible TIFs but outspoken enough to stop the irresponsible creation.