Generally, you can expect that the things he writes are reasonably logical. If you go to his page you will see occasions when he and I disagree on the conclusions we come to. That said, generally he provides information that can be verified and progresses in a logical manner.

Even though he and I disagree on what should have been the outcome of the vote on the Heathermere TIF (agenda item 10A) that council took the other night, I want you to start by reading his article. This is because people seem to understand what he writes better than when I write the same thing. So at least you will have a good foundation of knowledge to start. After that I will provide at least one more piece of information that would tend to make people want to vote against the proposal.

Finally, though I will talk some about why it should have passed.

WHY Tax Increment Financing (TIF) IS NOT ALL GOOD

Despite whUnderstand that TIF effectively take property tax money collected from "developments" that result in property value increases for some period of time from the county and give them to the local community to buy stuff to support that TIF district…and only that TIF district. By doing so, as new residents are added to the population of the County, the county is deprived of the additional resources necessary to increase their budgets, and thus their services, to meet the growing population demand for those services. So what services are we talking about? See the picture taken from the Montgomery County 2022 Budget documents.

The next time you wonder why there are no jails for criminals, why it takes so long to prosecute someone for a crime, why it takes so long to get a Sherrif response, why the courts are so backed up, why the county doesn't do more to support economic development, why more improvements aren't made to the Domestic Relations Court, why there aren't more prosecutors, why more isn't done to look at soil and water conservation, or the many other functions the County does for us, things the the City does not do for us, consider that we are increasing the population without increasing the resources the county has available to service ALL of us appropriately. We are all negatively impacted when this happens….not just those in the TIF district.

TIFS don't simply keep more money locally, they result in the county having fewer funds to serve a larger and growing population, negatively impacting the services we all receive from the County.

I am not okay with that. The City needs to live within its budget, and so does the County, just like each of us must do. That means prioritizing what we spend our resources on…..not taking resources from someone else because everyone else does it.

By the logic I've heard, we should all be out participating in retail theft because everyone else is and we want to get some of that….never mind that those businesses we are stealing from won't be able to service our needs as we have grown accustomed to in the future. Same thing applies here. Just because the law allows these TIFS, doesn't make it right. We should be setting the example and do the right thing and support our City, County, State, and Nation. If we can't, or won't, do that in a fair and equitable way, then we shouldn't complain when we don't get what we expect from those we treat this way. Just because you can do something, doesn't mean you should.

End of Paul's article:

I will start by talking about one aspect of TIFs that does not get mentioned much. The Assistant City Manager mentioned in a recent meeting that the City contributes to the TIF fund. Though I have been telling council members this for years, I don't think that even those that generally vote similarly to the way I would vote have fully understood that this "contribution" is city property tax. In other words, if the contribution wasn't going into the TIF fund, it would be going to fund Police and Fire services.

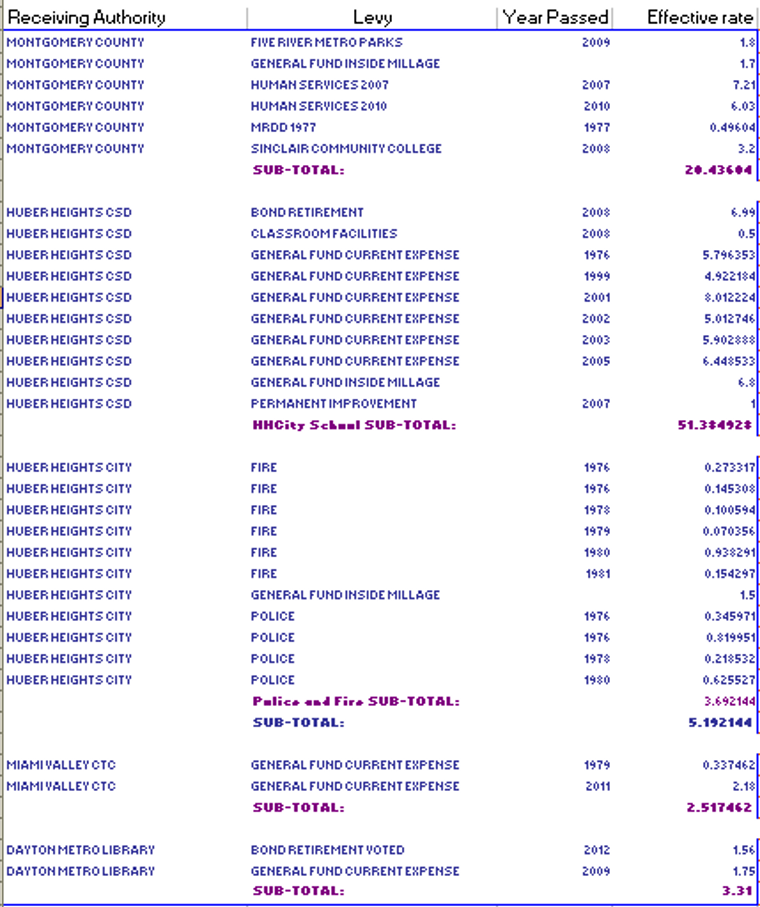

Back in 2014 the County Auditor actually published the mileage break out for each residence. For some reason he decided to stop publishing this useful tool a few years after this. So this table is a few years old. For this discussion though, it gives a close enough representation of the break down.

By adding up the effective rates, you can see there was a total of about 83 mils of property tax and the City would collect about 5 of those mils.

I wish it were possible to calculate how much money a TIF would collect simply by looking at a property tax bill, seeing that amount and then saying that will be the TIF collection. If that were the case, writing this article would be a lot easier. But that is not exactly how it works. Its kind of close, but not really.

That fact is that some of the total amount collected is not eligible for collection because only the value that the land increased after the TIF was created goes to the TIF. Not only that but some of the levies listed in the break out are exempt. That said, for simplicity sake, lets ignore the exempted levies.

With that in mind, look at an example where a property owner pays $4,000 in property tax with $3,000 of that tax going into the TIF Fund. Then you can do the math and see that 5 mils is approximately 6% of 83 mils so of the $3,000, $180 of that money would come from the City. More precisely, $180 would come from levies that normally pay for police and fire services.

Don't get big eyes like some members of council get and think, "well we are basically trading $180 to get $3,000". That was close to the case when the city forced 70/30 TIFs down the throats of the School Board. But now that we have gotten away from 70/30 TIFs and the City generally proposes only non-school TIFs, that $3000 is distributed so that the schools get all the money they would normally get without a TIF.

Looking at the mil break out you see that the HHCS and Miami Valley CTC get 54 of the 83 mils so of the $3,000 only about $1,000 goes to the City. So the real trade is $180 dollars that would normally go to Police and Fire for $1,000 that can only be spent on "infrastructure".

The point I have been making up until now is that council, when deciding if it makes sense to create a TIF and start collecting that additional ($1,000 - $180 =) $820, needs to take into consideration all that Paul wrote about that $1,000 and also this other aspect about the police and fire that Paul did not write.

——————————————————————————————-

Under what circumstances does it make sense to trade $180 dollars of police funding (and other county services) for $1000 of "infrastructure" money?

——————————————————————————————-

I am taking some liberty by incorporating other things Paul has written but I think we would both agree on this following situation.

When the Heathermere proposal was first presented everyone thought that there should be an additional road exiting the development. However, the proposed location would have taken it over a natural gas line. This made the road prohibitively expensive. I think Paul and I would agree, this is the kind of infrastructure investment that TIFs were designed to address. Paul and I might disagree on whether to create the TIF district for this purpose. The development is going to be built without that road, so obviously it's not totally necessary. So, it isn't illogical to say the residents could live without it. However, in my assessment, having that road would have been worth the trade.

That wasn't the situation for the vote the other night. We lost the opportunity to help those residents and so they and the adjoining neighborhoods will suffer unnecessary traffic headaches. Still I would have been in favor of creating the Heathermere TIF, if the funds collected there would have helped free up funds that should be going to improve the traffic situation on Old Troy Pike.

Unfortunately, your current council and mayor decided to trade Police and Fire services, County services and school funds in order to pay for the Veterans Memorial. In other words, they are using the I-70 TIF to pay for the Veterans Memorial. Yes, in this council's opinion the Veterans Memorial is an infrastructure project. They are sending money that should be going to make sure traffic flows properly on 202 down to Thomas Cloud. We can't do anything about that bad decision today except free up that money by finding it somewhere else. Though it is not optimal, I would trade $180 in police and fire services for $1,000 worth of traffic improvement. Of course, the hard part after that is to make sure that the "Thomas Cloud Improvements" that were mentioned as a purpose for this TIF really meant freeing up the I-70 TIF money. Unfortunately, I would have to fight those on council that think that building a sidewalk so Dayton residents can walk down to Dayton businesses is a legitimate Thomas Cloud improvement. I definitely would not make the $180 trade if their decision was to use the money to build that sidewalk.

I happened to be looking for something else and came across this video. It's relavant here because Mayor Fisher mentions TIF. Also, I am campaigning for a seat on City Council. I know there are members of this community that spend a lot of time telling people that when I was in office, I was mean when I argued. I thought this was a good reminder of how I got that reputation.

Edited

Edited

0 reviews: Unrated

There have been no comments yet